How to Build a Portfolio of ETFs

How to build a portfolio that is aligned with your investment needs

Key Concepts

- Your investment portfolio should be determined by your investment objective, time horizon, and risk tolerance.

- ETFs are designed to play particular roles in your investment portfolio, often providing exposure to particular geographic regions or market sectors.

- You can refer to an ETF's target market determination and factsheet to determine whether it is a good fit for you.

- Maximising diversification and minimising overlap across geographic regions and market sectors is key to building a healthy investment portfolio.

- Keep it simple.You shouldn't need more than 3-4 ETFs in your portfolio at once.

How to Build a Portfolio of ETFs

Investing is about a lot more than just picking the right stocks or ETFs. You have to consider how your investments work together and align to help you achieve your financial goals.

Investing is about managing risk and maximising the probability of success. A risky asset that goes up is a worse investment than a non-risky asset that goes down if it is not consistent with your financial needs.

But with so many options to choose from, the task of putting together an investment portfolio can be overwhelming.

Determining Your Needs

Step 1 of building your investment portfolio is determining what you need it to do for you.

There are generally three factors that you should consider when building your portfolio: your investment objective, your time horizon, and your risk tolerance.

Investment Objective

Your investment objective is the main thing you want to achieve by investing. It could saving for something significant, like a deposit on your first home or a holiday to Europe, saving for retirement, or generating another source of income.

Time Horizon

Your time horizon is how long you expect to be invested for.

Time horizon is generally categorised as short-term (less than 5 years), medium-term (5 to 10 years), or long-term (more than 10 years).

Your time horizon is closely related to your investment objective. If you are saving for a significant future expense, your time horizon is simply the amount of time between now and then. If you are investing for supplemental income, your time horizon is how long you need that income for.

Risk Tolerance

Risk tolerance is how much risk (probability of permanent loss) you can afford to take on.

This depends on many things, including the portion of your assets that you intend to invest, the portion of you will be investing each month, and your personal relationship with risk.

If the prospective of losing more than 10% of your capital keeps you up at night, then you likely have a low risk tolerance.

Your ability to bear risk can be a limiting factor on achieving your investment objective. For example, your investment objective may require you to earn an average return of 8% of the next 5 years. If you have a low risk tolerance, this return is unrealistic and you may have to rethink your objective by reducing your budget or pushing the date back.

You can read more about the risk reward relationship here.

Building Your Portfolio

Now that you have your investment objective, time horizon, and risk tolerance you can start building your investment portfolio.

ETFs come in many flavours. They are commonly designed to provide broad exposure to a particular geographic region or market sector.

For example, the Vanguard Australian Shares ETF (VAS) is designed to provide exposure to Australian companies and property trusts.

Building your investment portfolio is about two things:

- Selecting the ETFs that are most closely aligned with your investment objective, time horizon, and risk tolerance.

- Allocating an appropriate portion of your portfolio to each investment to maximise diversification and minimise overlap across geographic regions and market sectors.

These steps are closely related and should be considered at the same time. Selecting an ETF for your portfolio (1) requires you to consider how it is related to your other investments and whether it brings anything new to the table (2).

There are two documents that can help you with the proccess of building your investment portfolio.

The first document is called a target market determination or TMD. This is a regulatory document that ETFs listed on the ASX are required to provide. It outlines the types of investors that the ETF is designed for by their objective, risk tolerance, time horizon.

However, there are likely hundreds of ETFs where the target market determination aligns with your investment needs. So should you just go and buy them all?

The second document that can help with this is the factsheet. This provides details about the underlying fund, such as its top holdings, its allocation to market sectors and geographic regions, and its fees. The factsheet is not required by law, like the TMD, but most ETFs will have one.

You can read more about how to find the right ETFs here.

Geographic Allocations

Australia

Assuming you live in Australia, investing in Australian shares is a logical place to start.

When you invest in Australian shares you are likely investing in companies you know, like BHP and Commonwealth Bank.

Another feature that makes Australian shares attractive to many investors is Australia's imputation tax system. Due to the favourable tax treatment of dividends, Australian companies tend to return capital to shareholders through dividends rather than reinvesting in the business. This can be great if you are an Australian resident and have an income objective.

Another advantage of investing in Australian shares is that they are not directly affected by fluctuations in the Aussie dollar (which is one less thing to worry about).

However, the largest companies in Australia tend to be from the mining or banking sectors. These sectors tend to be sensitive to the economic cycle, meaning they can undergo long episodes of slower or negative growth corresponding with economic activity. This, combined with a focus on dividend income over capital growth, means Australian shares should likely be a lower allocation in your portfolio if you have a growth objective.

United States

The United States is the largest economy in the world and is the home of the largest companies in the world. Think Apple, Microsoft, Amazon, Facebook, and Google. Also McDonald's, Coca Cola, Ford, Nike, Colgate, and Procter & Gamble. It's very hard to go about your day without interacting with American brands.

To illustrate the size of the US market, the total market capitalisation of all the publicly listed companies in the US accounts for almost 50% of the total market capitalisation of all publicly listed companies in the world. By comparison, the total market capitalisation of all the publicly listed companies in Australia is only about 1.5% of the global total.

That alone should be reason enough for most investors to have at least some of their portfolio invested in the US.

The US share market is highly concentrated in the technology sector, which is a sector that tends to grow quickly but experience greater volatility. Therefore, having a higher allocation to the US may be appropriate if you have a growth objective.

Europe

Europe is home to some of the world's largest and most established economies, including Germany, France, the United Kingdom, and Switzerland. Collectively the region represents a significant portion of the global economy.

Companies you may be familiar with include Nestlé, LVMH (the owner of Luis Vitton, Dior, and Moët & Chandon), Unilever, and Siemens.

An attractive feature of investing in Europe is diversification. The European market is diversified across geographic regions and is not heavily concentrated in a particular sector like the Australian or US markets.

However, Europe's economic growth has generally been slower than that of the global economy over the last 20 years.

Having a higher allocation to Europe may be appropriate if you have a low risk tolerance and are seeking to diversify into countries other than the US.

Emerging Markets

Emerging markets refer to developing nations that are experiencing rapid growth as they become more integrated with the global economy. This category includes countries like India, China, Mexico, Russia, Saudi Arabia, and Brazil.

Investing in emerging markets can provide higher potential for growth but come with an increased risk.

Sector Allocations

Different market sectors have different risk-return profiles and are impacted differently by the phases of the economic cycle.

Depending on your investment objective, time horizon, and risk tolerance you may want to have a higher or lower allocation to particular sectors.

| Sector | Characteristics |

|---|---|

| Technology | High potential growth, higher volatility |

| Financials | Cyclical, stable dividends, sensitive to interest rates |

| Healthcare | Defensive, steady long-term growth |

| Consumer Staples | Defensive, consistent returns throughout economic cycle |

| Materials | Cyclical, sensitive to economic cycle |

| Consumer Discretionary | Cyclical growth, volatile |

| Industrials | Economic sensitivity, moderate volatility |

| Energy | Inflation hedge, commodity-linked |

| Real Estate (REITs) | High dividend yields, inflation hedge |

Keep It Simple

Everything should be made as simple as possible, but not simpler. - Albert Einstein

How many ETFs should you have in your portfolio?

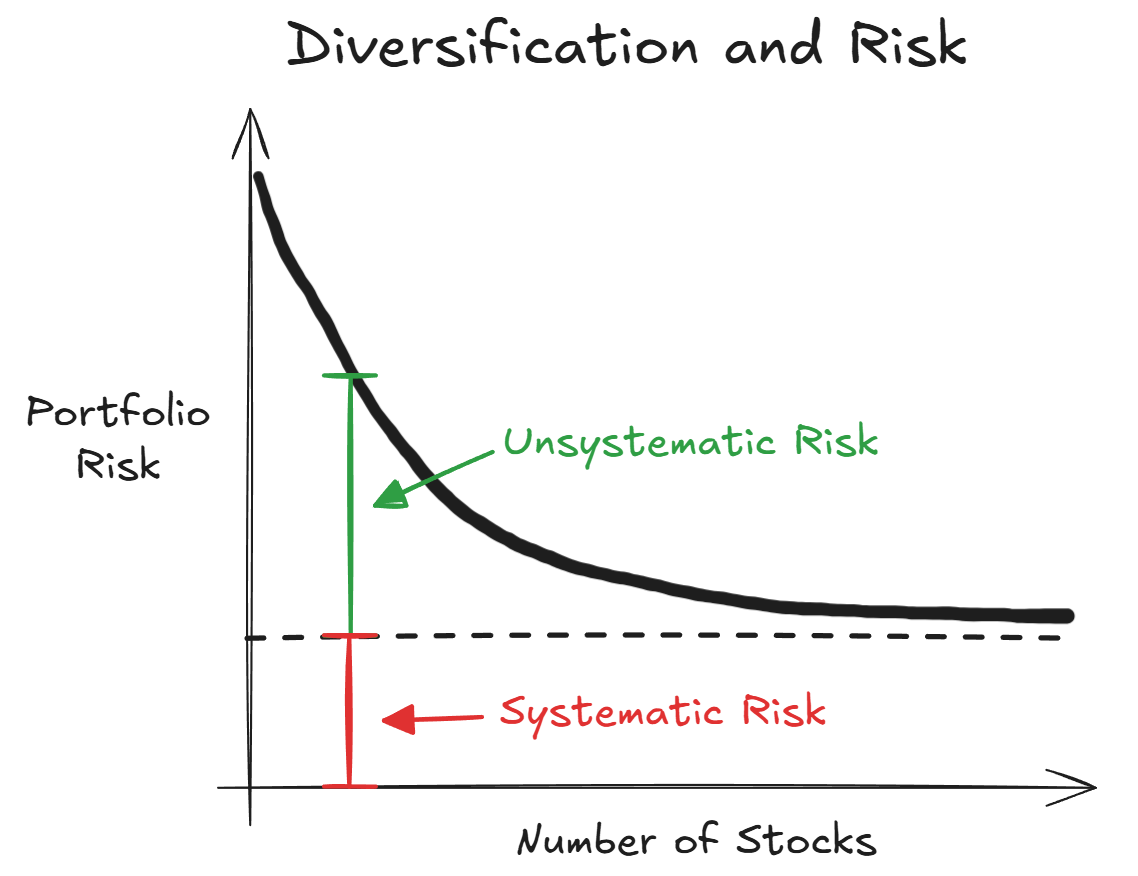

Diversification is a great way to reduce unsystematic risk and is a key part of having a healthy investment portfolio. However, due to diminishing returns, adding too many ETFs to your portfolio can add unnecessary complication and just make it harder for you to manage.

Some ETFs, like the Vanguard Diversified High Growth Index ETF (VDHG), are designed to take up to 100% of your portfolio on their own. If you are investing small amounts of money or you want a minimal effort solution, an ETF like this may be appropriate for you.

Other ETFs, like the Global X Robotics & Automation ETF (ROBO), are only designed to be a minor allocation in your portfolio. An ETF like this can be appropriate if you want targeted exposure to a particular industry or investment theme.

The allocation that an ETF is intended to have in your portfolio is required to be listed in the ETF's target market determination. So if you are unsure about how much to invest in a particular ETF, you can always refer there.

In general, ETFs are already highly diversified products and you shouldn't need more than 3-4 ETFs to achieve your investment goals.

The simpler your portfolio, the easier it is to manage and the more time you can spend enjoying the other things in your life. Agonising over tiny details only causes you unneccessary stress and likely won't impact your returns enough for you to notice in five to ten years.

If done properly, you should be able to sit back, relax, and watch as your portfolio does its thing.

This article is intended for educational purposes only. The information provided is general in nature and does not consider your personal financial circumstances. Please consult a certified financial advisor if you require advice.