What is the Financial Advice Gap?

Rising cost of living and falling adviser numbers are creating a financial advice gap. What exactly is it, what's causing it, and what can be done about it?

If you're feeling overwhelmed by your finances, you're not alone. In fact, 2 in 3 Australians are feeling the same way.

With the rising cost of living, making smart money decisions is more important than ever. Yet if you wanted to seek help with your finances, it has never been harder to access professional financial advice.

A 2023 report by Iress and Deloitte found that 11.8 million Australians have advice needs that are not being met.

This disconnect between the number of Australians needing financial advice and the number of qualified advisers available to serve them is called the financial advice gap.

But how exactly did we get here and what can we do about it?

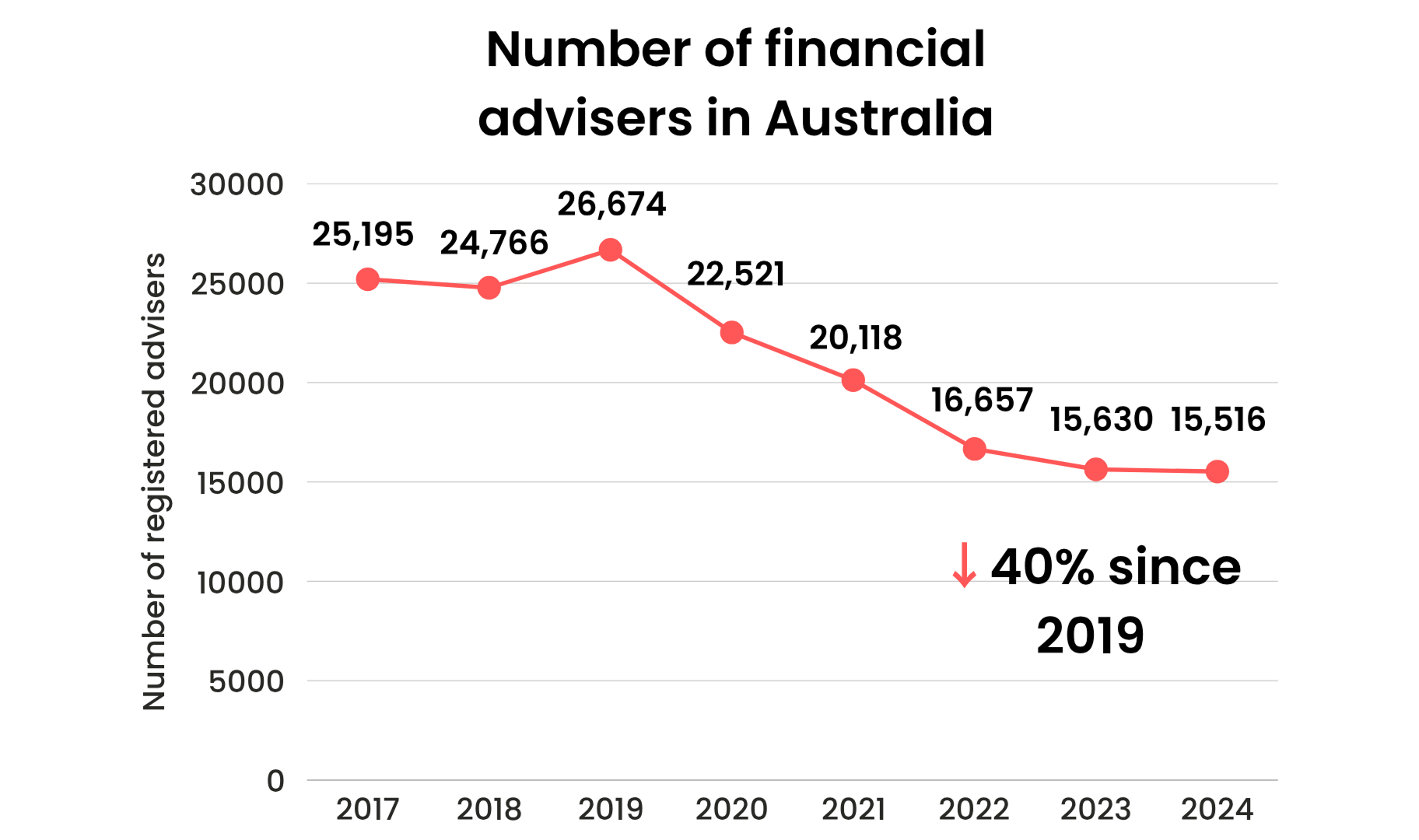

Falling Adviser Numbers

The number of qualified financial advisers in Australia has plummeted in the last few years, primarily due to the Hayne Royal Commission.

Officially known as the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, the Commission was initiated in 2017 to investigate and report on misconduct in these industries.

The investigation was concluded in 2019 and found conflicts of interest, poor ethical standards, and inappropriate or misleading advice were widespread.

This meant that many advisers were advising clients to buy products that would benefit the adviser in some way, rather than what was in the best interest of the client.

In almost every case, the conduct in issue was driven not only by the relevant entity's pursuit of profit but also by individuals' pursuit of gain, whether in the form of remuneration for the individual or profit for the individual's business. Providing a service to customers was relegated to second place. Commissioner Kenneth Hayne AC, 2019

In response, the Australian Government introduced a new ethical standards, and greatly increased educational standards and reporting and disclosure requirements for financial advisers.

Many existing advisers did not meet the newly increased educational standards, which prompted many to leave the industry.

Further exacerbating the situation, increased compliance costs caused many institutions to scale back or shut down financial advice services.

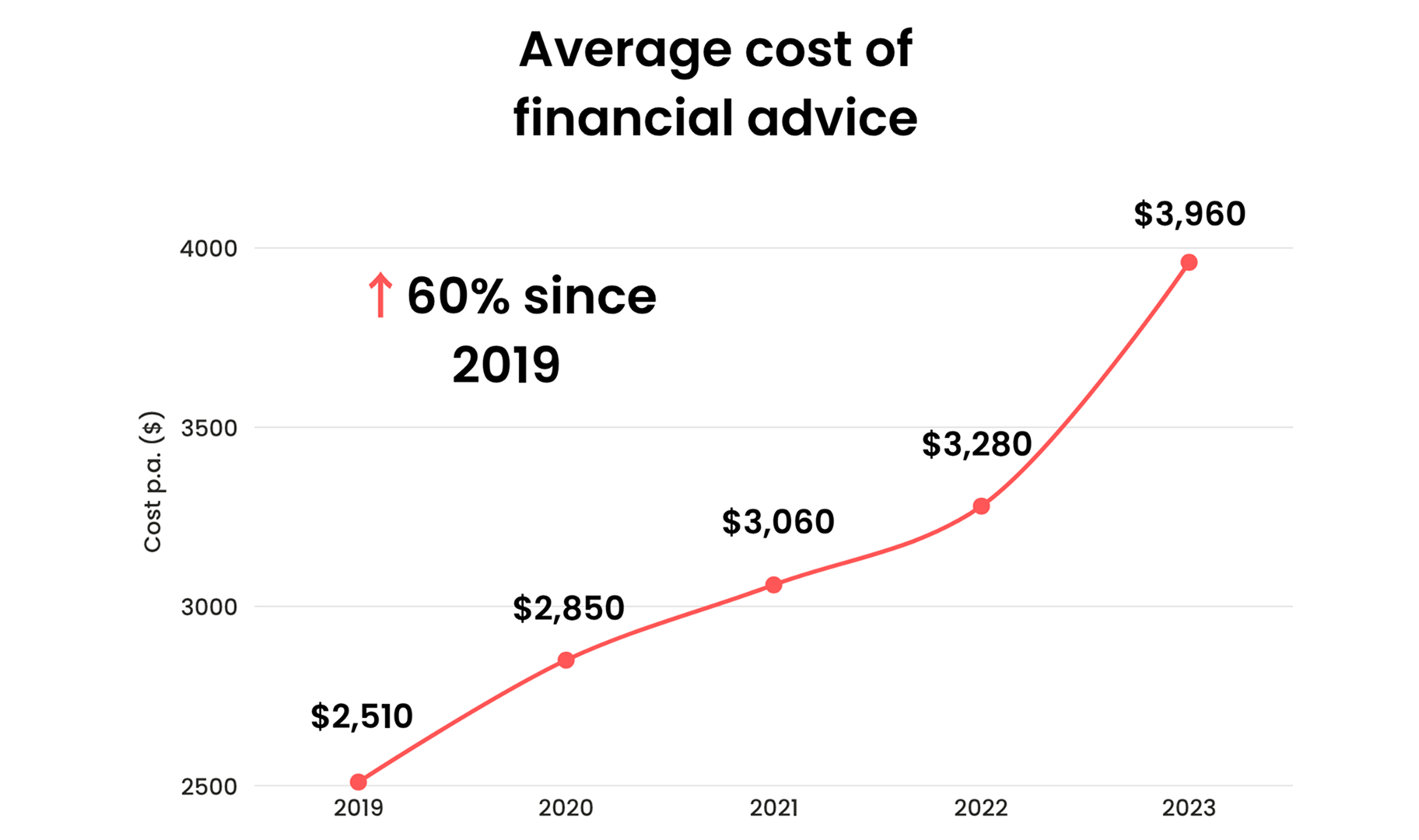

The significant reduction in qualified advisers and heightened compliance costs have caused the average annual cost of financial advice to surge from $2,510 in 2019 to $3,960 in 2023.

Cost of Living Crisis

While supply has been falling on one hand, the demand for financial advice has been rising on the other.

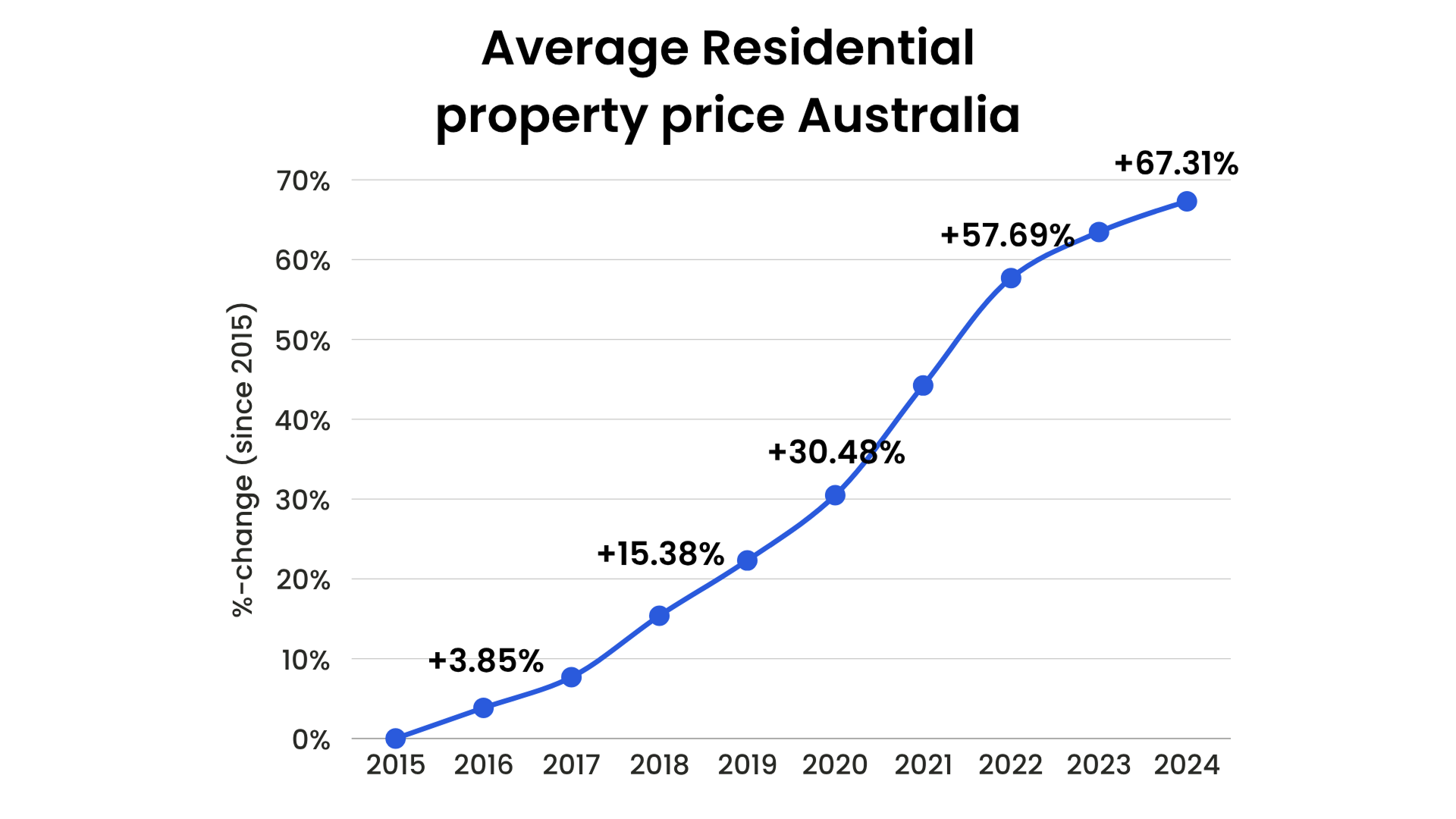

Australia is grappling with a cost of living crisis driven by the rising cost of essential items such as food, energy, and housing.

Wages have also grown, but not enough to keep pace with increasing costs.

To put this it perspective, the median weekly salary in Australia is $1,512 at the time of writing. The median house price in Sydney is $1.65 million.

Using the typical 30% of income towards housing, the average Australian worker needs to work for 3,637 weeks, or almost 70 years, to purchase the median house in Sydney (ignoring interest and other associated costs).

It's no wonder that only 28% of Australians are feeling optimistic about their financial future.

Younger Generations Affected Most

The financial advice gap is disproportionately affecting younger generations.

Research by ASIC's Moneysmart program found that for 7 in 10 Gen Zs, finances are a major source of concern (versus 57% for other generations).

The research also found that Gen Z is twice as likely as other generations to want to better manage their finances.

Yet data from Westpac reveals that the median savings balance among their Gen Z customers is only $2,410. So at $3,960 per year, professional financial advice is simply out of the picture.

To fill the gap, young Australians are turning to social media such as Tiktok, Instagram, and YouTube for advice.

This reliance on social media has its own downsides, such as the prevalence of misinformation and scams and the popularity of risky "get rich quick" schemes.

How do we fix this?

The need for accessible and affordable financial advice is clear.

It is also clear that the only way to provide financial advice affordably and scalably is through technology.

I am convinced that digital advice tools can make good quality financial advice widely available. Michelle Levy, Quality of Advice Review 2022

For the most basic financial needs, digital advice tools can provide quality financial advice at a fraction of the cost of a human adviser.

Technology has its own limitations, but it is the future.

By carefully embracing that future, and keeping in mind the lessons of the past, we can finally bridge the financial advice gap and restore hope to the millions of Australians in need.

That's exactly what we're doing at Pocket Adviser.

This article is intended for educational purposes only. The information provided is general in nature and does not consider your personal financial circumstances. Please consult a certified financial advisor if you require advice.