Key Concepts

- Risk is the degree of uncertainty in the expected return of an investment.

- Investors are generally risk-averse, meaning they prefer to make choices that involve a greater degree of certainty around the outcome.

- Assets with a higher degree of uncertainty generally have a higher expected return.

- Making more money from investing requires you take on more risk.

Risk and Reward

High risk, high reward. - common expression in investing, and gambling...

Investors have many asset classes to choose from to invest in, including government and corporate bonds, real estate, private equity, and venture capital. Each of these options involves a different level of risk. Risk is defined as the degree of uncertainty in the expected return of an investment. For example, government bonds are considered among the safest investments because it is virtually guaranteed that you will receive the return promised (governments can always print more money if they run out). On the other end of the spectrum is venture capital, which involves investing in startups and smaller companies. This involves a higher level of risk because these businesses are unproven and often unprofitable, and there is a high degree of uncertainty about whether they ever will be.

Humans are generally risk-averse, meaning we prefer to make choices that involve a higher degree of certainty about the outcome. Why would I invest in a risky startup when I could buy a government bond and get a guaranteed return? Well, you shouldn't, unless the expected return on the riskier asset is sufficiently large to make up for the increased risk.

To see what I mean imagine you are presented with two options where the expected value is identical.

- Option A - receive $50 right now.

- Option B - flip a coin and receive $1,100 if it lands on tails and lose $1,000 if not.

Even though the expected value between the two options is the same, the certainty of Option A seems more attractive than in Option B due to the possibility of losing $1,000. A risk-averse investor will always choose Option B. If you don't feel this way, what if each of the values were multiplied by 100 and the worst-case scenario now loses you $100,000?

Luckily, you don't have to imagine it. Use the simulator below to try this out for yourself.

Coin Flip Game

Now let's think about how much you would pay to play this game. Option A is pretty straight forward. Since the $50 is guaranteed, you would logically pay anywhere up to $49.99 which would profit you $0.01 every time.

Option B is less straight forward. Because of the possibility of losing money, you may not be willing to pay as much for Option B (assuming you don't have unlimited money to lose). In other words, you would require a greater expected return to select Option B over Option A.

Pricing the Coin Flip Game

Risk and Return in Financial Markets

Stocks are a risky asset class. This is because stock returns are proportional to how much money the company makes, which in turn are heavily influenced by the economy among other factors. There are so many factors that can influence share prices that predicting them is incredibly difficult. The range of potential outcomes is wide, so investors demand a higher rate of return just like in the coin flip game above.

This is as opposed to corporate bonds which are a less risky asset class. Bonds promise to give the investor a fixed rate of return as long as the underlying company remains in business. The range of potential outcomes is much smaller, so investors are happy to accept a lower rate of return compared to stocks.

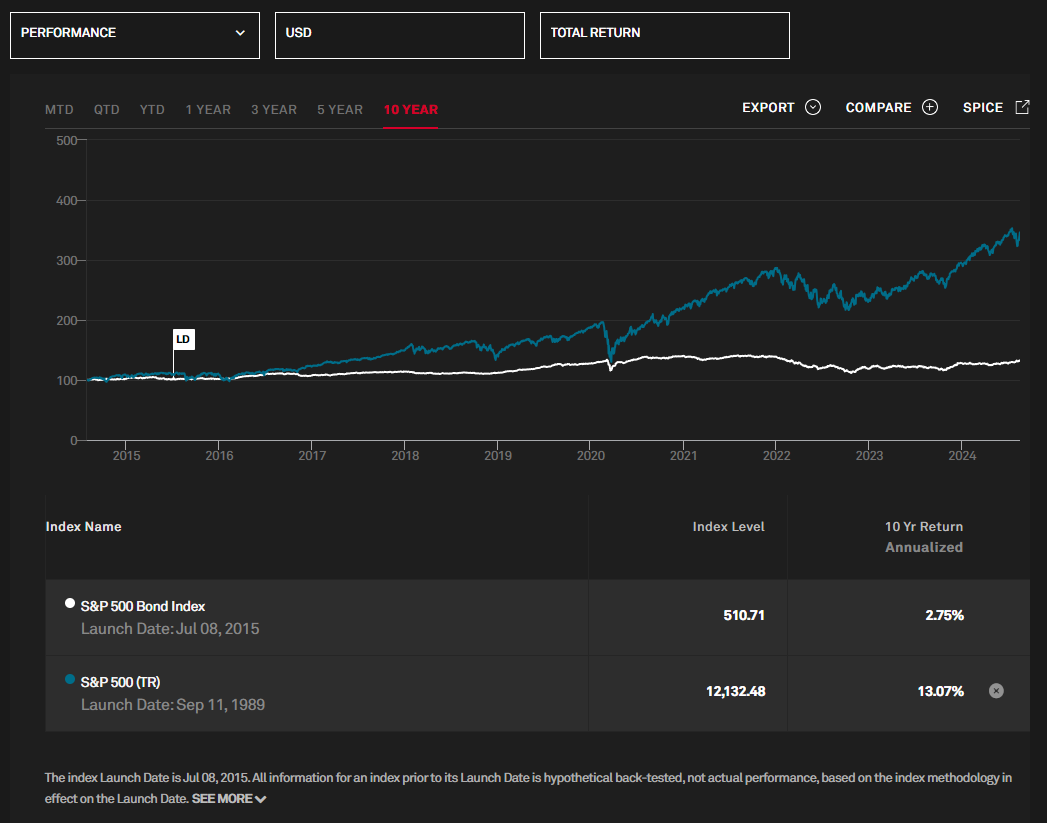

The relationship between risk and reward is evident when we plot the returns of an asset class with low risk like bonds versus a risky asset class like stocks.

You can see that stocks have significantly outperformed bonds over time. So while the average return of the S&P 500 might be 10%, it has fallen as much 36% in some years (2008) and risen by over 30% in others.

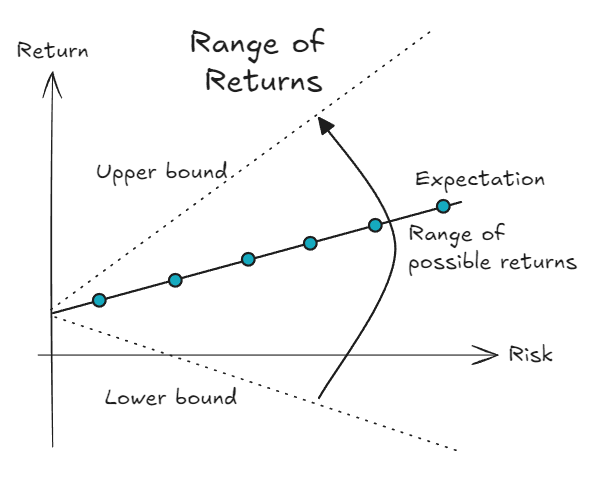

When I first saw the capital market line I thought, "I'd like a high return, so all I have to do is invest in the riskiest assets!" By thinking this, I failed to see the ever increasing range of possible returns as you move from right to left along the CML.

For this reason, the above plot of the capital market line (which is the standard in finance textbooks) is misleading. A better plot would show all potential returns, not just the expected one.

If the price of an asset tomorrow, or one year from now, was known to be signficantly higher than it is today, investors would simply buy into it and bid up the price until there was no longer any return to be earned. In other words, the risk-reward relationship exists precisely because we can never know for certain what will happen in the future.

Risk, or uncertainty in outcome, is the price you pay for high returns. Earning outsized returns requires taking on some level of risk or uncertainty. But that does not mean simply taking on as much risk as possible is the answer. There is never a guarantee that the high return outcome is the one that eventuates. With increasing risk, the probability of experiencing negative outcomes also increases.

This article is intended for educational purposes only. The information provided is general in nature and does not consider your personal financial circumstances. Please consult a certified financial advisor if you require advice.